All Copy and No Innovate Makes Amazon a Dull Boy

With the arrival of the Christmas holidays and the New Year, competition among overseas e-commerce platforms has reached a fever pitch. Recently, foreign media reported that Amazon, the world’s largest e-commerce giant that once strongly condemned low-price competition, is attempting to replicate the strategies of Chinese e-commerce. It has introduced a new section featuring products and interfaces that closely resemble those of Chinese e-commerce platforms. The rapid development of Chinese e-commerce has undoubtedly put significant pressure on Amazon.

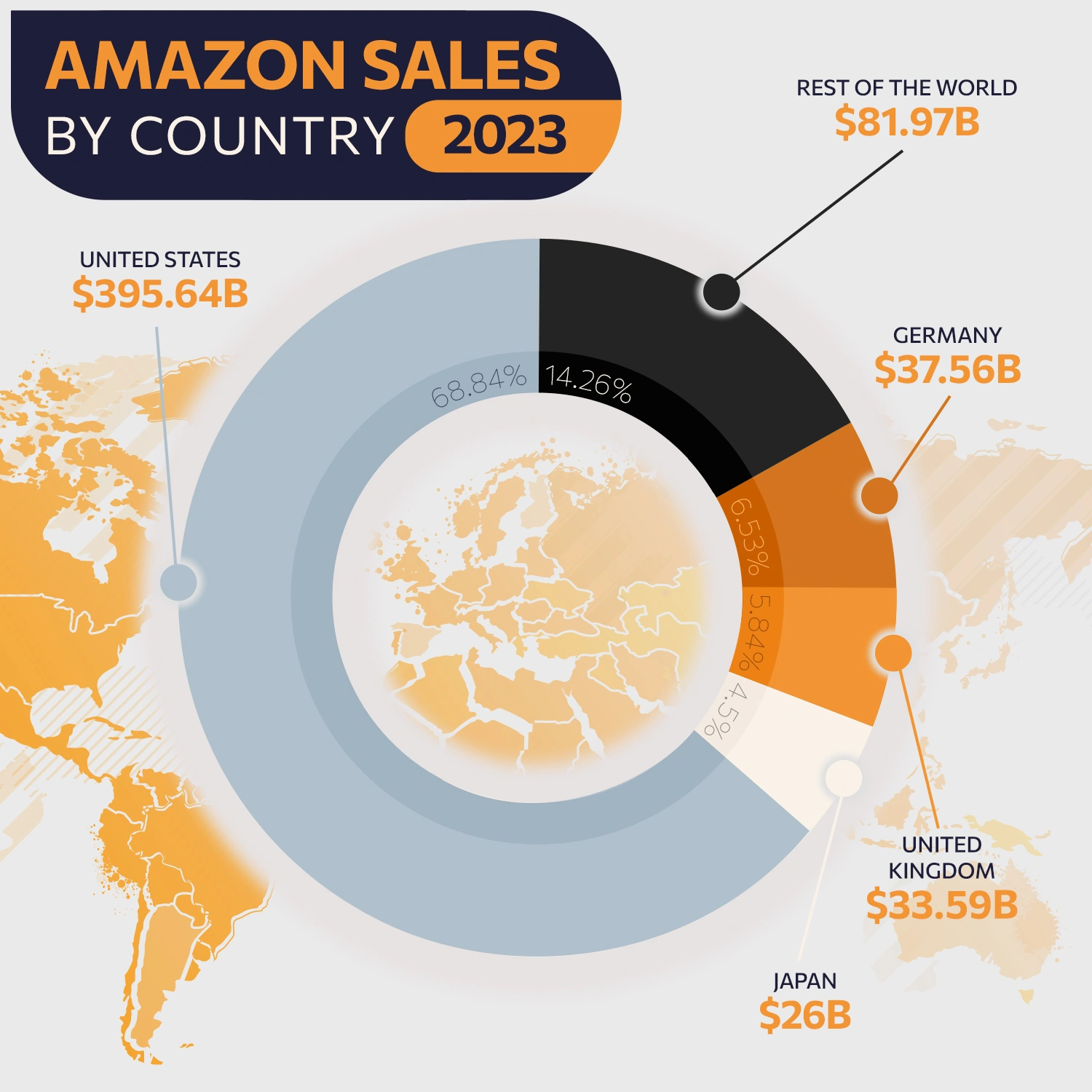

In fact, Amazon significantly outpaces its U.S. peers such as eBay and Walmart, as well as competitors like AliExpress, Temu, and SHEIN, in terms of scale and degree of internationalization. In 2023, Amazon achieved net sales of $574.8 billion, a 12% year-over-year increase, with a net profit of $30.4 billion. By comparison, JD.com, the Chinese e-commerce company with the highest revenue, posted an annual revenue of RMB 1.0847 trillion in 2023.

Amazon’s presence in the Chinese e-commerce market remains limited, primarily focused on selling books. However, it operates 19 sites worldwide, spanning North America, South America, Europe, the Middle East, and Asia-Pacific regions. In terms of internationalization, Chinese e-commerce platforms, which rely primarily on their domestic market, still lag behind Amazon to some extent.

Amazon’s presence in the Chinese e-commerce market remains limited, primarily focused on selling books. However, it operates 19 sites worldwide, spanning North America, South America, Europe, the Middle East, and Asia-Pacific regions. In terms of internationalization, Chinese e-commerce platforms, which rely primarily on their domestic market, still lag behind Amazon to some extent.

Although Amazon’s presence as an e-commerce platform in China is relatively inconspicuous, its business operations remain closely tied to China. A significant proportion of the products sold on Amazon and its third-party sellers originate from China. By the end of 2023, third-party seller transactions accounted for 61% of Amazon’s platform sales, far exceeding its self-operated sales. Among these sellers, 63% were based in China, while 71% procured their goods from Chinese sources.

Despite Amazon’s high platform fees—including a 17% sales commission, advertising costs, and logistics fees that can climb up to 25%—Chinese cross-border merchants still rely on the platform due to its vast global reach. As a result, the global e-commerce landscape is still predominantly led by American companies such as Amazon and Walmart.

The rapid rise of Chinese e-commerce has shifted Amazon’s approach from disregard to vigilance. Data shows that by August 2024, Temu’s global user base had reached 91% of Amazon’s. In response, Amazon has begun adopting strategies from the success of Chinese e-commerce. It has implemented price caps, strengthened supply chain management, and reduced commission fees for small goods to attract higher monthly active users. Additionally, leveraging its extensive global logistics network, Amazon has started embracing the “full-service fulfillment model” pioneered by Chinese e-commerce platforms.

However, simply copying the pages, strategies, and mechanisms of Chinese e-commerce platforms is unlikely to replicate the core foundation of their success. According to a consumer survey conducted by an overseas platform, among those who favored emerging e-commerce platforms like Temu, half of them cited low prices as the main reason, while 47% particularly enjoyed the “treasure hunt” experience. This actually reveals the core of Chinese e-commerce’s success beneath its low-price strategy.

On one hand, this success is closely linked to China’s powerful supply chain system. The products on Chinese e-commerce platforms not only offer high cost-performance and a wide variety, but are also able to provide personalized small products for the global market. Behind the high level of e-commerce operations lies China’s advanced standards in productivity, logistics, digital economy, and communication networks. The efficient collaboration and digital transformation have also enhanced the flexible manufacturing capabilities of small and medium-sized enterprises.

On the other hand, the Chinese e-commerce ecosystem, shaped by extensive feedback from Chinese consumers, has matured significantly, with features like personalized recommendations, scene innovation, and high-frequency interactions. This success can be attributed to China’s status as having the largest internet user base and e-commerce market in the world. According to the China Postal Service, it is estimated that 142.5 billion parcels will be delivered in 2024, with an average of 4,187 parcels being collected every second. The vast consumer data generated by millions of e-commerce users enables platforms to create more accurate user profiles, improving the precision of algorithms like personalized recommendations. Additionally, this allows designers to shorten their innovation cycles, leading to a continuous stream of fresh products.

From a global perspective, although Amazon had the first-mover advantage, the more mature Chinese e-commerce system is becoming a model for e-commerce platforms worldwide. It also offers more diversified choices for global cross-border merchants facing high commissions and complex regulations on traditional platforms. There was a time when Chinese companies sought to learn from international best practices; today, thanks to years of focusing on efficiency, optimizing operations, and prioritizing customer feedback, Chinese e-commerce platforms are sharing valuable “Chinese experience” with the world, advancing together with the global community through both competition and collaboration.

Editor: Anymuoons

Anonymous

Bullshit china dumbass propaganda

Anonymous

Sure hope Amazon agrees with you. Close your eyes, plug your ears, turn off the lights.. go to sleep, baby. Everything will be alright….

Anonymous

Then why did you click it ?

Anonymous

the elite …Oligarchic Blood Lines, Corporatistic Money Lines, and Ascensionalistic Power Lines…. and their versions of …Family Values, Freedom Values, and Functional Values…. playing out in The World.

Anonymous

The current state and potential of …Money, Propaganda, and Visioneering…. resides among the elite …Oligarchic Blood Lines, Corporatistic Money Lines, and Ascensionalistic Power Lines…. and their versions of …Family Values, Freedom Values, and Functional Values…. playing out in The World.

An open and ongoing, integrally developing, and conscientiously advancing human …sense, science, and salience…. from the bottom-up needs an authentic developing ‘peer review science’ to flourish alongside it.

Anonymous

please elaborate…

Anonymous

Appear weak when you are strong, and strong when you are weak — Sun Tzu