The Visible Hand: The Role of Government in China’s Long-Awaited Industrial Revolution

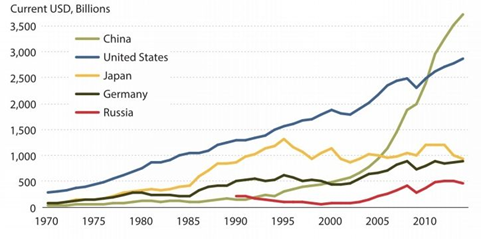

China’s economic transformation has astonished the world. Even as recently as 20 years ago, few would have predicted China’s dominance as a regional industrial power, let alone a global superpower. In merely one generation’s time, China has created more productive forces than have the past 5,000 years of its previous dynasties and transformed from an impoverished agrarian nation into the world’s largest and most vigorous manufacturing powerhouse. (See Figure 1.)

Manufacturing Output (1970-2014), Top 5 Countries in 2014

SOURCE: United Nations.

In one year, China can produce 50 billion T-shirts (more than seven times the world’s population), 10 billion pairs of shoes, 800 million metric tons of crude steel (50 percent of global supply and 800 percent of the U.S. level of production), 2.4 gigatons of cement (nearly 60 percent of world production), and close to 4 trillion metric tons of coal (burning almost as much coal as the rest of the world combined). China is the world’s largest producer of passenger cars, high-speed trains, ships, tunnels, bridges, highways, machine tools, cell phones, computers, robots, air conditioners, refrigerators, washing machines, furniture, fertilizer, agricultural crops, pork, fish, eggs, cotton, copper, aluminum, books, magazines, television shows, as well as college students (see Wen,2016a).

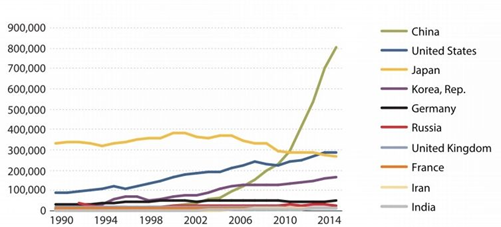

Moreover, China is now the world’s number one industrial patent applicant. For example, China’s industrial patent applications were more than the sum of those in the United States and Japan in 2014. (See Figure 2.)

Figure 2

SOURCE: World Intellectual Property Organization (WIPO); see also Agence France-Presse (2014).

How did China achieve all this in a mere 35 years, when many observers were actually betting on its collapse? Critics called attention to the Tiananmen Square incident, the collapse of the Soviet Union and Eastern European communism, the Asian financial crisis, and the 2008 global recession, which cut China’s total exports persistently by more than 40 percent below trend. Yet, China persisted through its industrial revolution and has achieved an astonishing 30-fold expansion of real GDP since 1978. This transformation was unexpected not merely because of China’s pervasive backwardness after centuries of turmoil and economic regress, but also because of its enduring “extractive” and authoritarian political institutions. According to the new institutional theories of economic development, the existence of these obstacles predicted nothing but dismal failure for China. For example, the celebrated book, Why Nations Fail: The Origins of Power, Prosperity, and Poverty, articulates this perspective (Acemoglu and Robinson,2012).

This skepticism does have some historical support: Since 1860, all of China’s previous attempts at industrialization had failed. China in the 1950s, under the government of Mao Zedong, was on the threshold of true economic growth. Its state-owned enterprises at the time were motivated by the goal of rapidly catching up with the Western industrial powers, such as Great Britain and the United States. But China attempted to achieve this goal by full-fledged industrialization through central planning based on (i) “leapfrog” developmental strategies biased toward heavy industry and (ii) industrial policies of self-reliance and self-sufficiency. Yet this newly created industrial base produced goods to meet only very thin, limited domestic demand in China. Thus, these enterprises were highly unproductive and inefficient. Sustainable industrialization was once again out of reach.

Two decades later, in the late 1970s, China detonated a true industrial revolution. Today, China’s government and firms are guided by well-known economic principles. But these are not contemporary principles; these are the well-known yet often-ignored principles of Adam Smith (Wealth of Nations,1776). Smith explained the wealth of nations by the division of labor based on the size of the market, using examples from 18th-century pin factories. More specifically, it has been China’s approach to creating markets that has laid the foundation for its success. Instead of taking as given the neoclassical assumption that the free market automatically exists (and would be automatically created by free individuals on the supply side in the absence of any government effort or intervention), the Chinese government has taken the initiative and expended enormous effort to create both domestic and international markets for Chinese firms. This approach is analogous to what the European monarchies and powerful merchants (such as the English East India Company) in the 16th to 18th centuries had done since the Age of Discovery, including the colonization of the Americas.

Unlike the European nations of the 16th to 18th centuries, however, China in the late 1970s did not have a class of wealthy, savvy, entrepreneurial merchants to create markets by organizing the means of production, commerce, and transportation. The Chinese government relied, instead, on government officials with desirable leadership characteristics: These were capable, business-minded administrators who helped create local, national, and international markets for local business by supporting village firms with low taxes and cheap land, attracting outside investment, advertising local products, negotiating business deals, and building distribution networks. Such a structure could have resulted in bureaucratic stagnation. But under Deng Xiaoping’s system of merit-based selection and competition, any officials who were ineffective in finding ways to bring material wealth to local populations would lose their positions under fierce intra-national competition for economic success in the villages, townships, counties, cities, and provinces. This pragmatism effectively turned all levels of Chinese government officials, through the administrative networks initially established by Mao Zedong during his 30 years of communist central planning experiments, into a highly motivated “public merchant” class. These public merchants were China’s market creators.1

With an enormously expanded and deepened market, China eventually set off its long-awaited industrial revolution. Indeed, China’s modern firms, regardless of their ownership type, operate according to the Smithian market-size principle to compete and meet the demand of well-developed and well-enriched domestic and international markets. Many of China’s modern firms, while state-owned, have been highly productive, competitive, and profitable because they have the mass market to support their large-scale mass operations; comparable Chinese firms in the 1960s were highly unprofitable because they had no such markets or market mechanisms.

The objective of this article is to provide a brief summary and road map for Wen’s (2016a)New Stage Theory (NST) of market creation and economic development, drawn from China’s growth experiences and the economic history of the West.2 We will describe the stages (and the sequence of those stages) of market creation and identify the sometimes easily overlooked steps that China’s government took to successfully generate a full-fledged industrial revolution after 1978. This last point is critical: The Chinese central and local governments relied on China’s state banking system and public land ownership to help create one of the largest unified manufactured goods markets in world economic history; this market nurtured, supported, and incentivized firm entry and industrial upgrading through the demand-side-driven adoption and market-oriented invention of modern manufacturing technologies and industrial organizational changes. Only toward the end of its second industrial revolution (which featured mass production of heavy industrial goods) did China begin to seriously engage in creating a financial market, pushing for the internationalization of its currency, and establishing market-based financial regulatory institutions to manage financial capital flows. China’s prudent sequence of market creation explains the absence of any recurrent and destructive financial crises that have dominated the developmental history of the West and Latin America. China’s sequential and “engineered” market-creation process thus offers a new model of economic development for developing countries. Behind the core economic validity of this market-creation strategy is an equally compelling reality: Political stability and social trust are the most fundamental pillars of the “free” market; forces that undermine stability and trust (such as premature and radical top-down political-economic reforms) can undermine the market itself. And it is worth noting here the distinction between the concept of an absolutely free market and the actual “free” markets in modern China, which are vibrant but directed by the government. This direction, or intervention, as noted throughout this article, is based on balancing the creative powers and the destructive powers of market forces.

(For the full article please check: https://research.stlouisfed.org/publications/review/2016/09/12/the-visible-hand-the-role-of-government-in-chinas-long-awaited-industrial-revolution/ )

Editor: Leo Cai