Macron’s Move Against China Makes French Farmers Suffer

On October 29, the European Union officially approved a hefty tariff on Chinese-made EVs, citing the need to protect European manufacturers. France and Italy both voted in favor, their motives clear: pushing Chinese automakers to set up production facilities within Europe.

China’s EV manufacturers, however, had already been eyeing Europe for production. SAIC, China’s second-largest auto exporter, is scouting European sites for an EV factory and plans to open a second European parts center in France this year to support growing demand for its MG brand. Italy is negotiating with China’s largest exporter, Chery, along with other Chinese automakers like Dongfeng, for potential investments.

SAIC Motor’s new EV model, MG4 ELECTRIC, departed from Haitong port in Shanghai and handed to Europe

SAIC Motor’s new EV model, MG4 ELECTRIC, departed from Haitong port in Shanghai and handed to Europe

Yet, Chinese companies are cautious about investing in countries that have backed the EU’s tariffs, wary of potential future obstacles even after establishing factories on European soil. This caution could make France and Italy’s hopes of attracting Chinese investment little more than wishful thinking.

France’s EV industry has struggled from the outset, hampered by a fragile supply chain. President Emmanuel Macron’s plan to stimulate the French market with Chinese EVs and accelerate the green transition may now be at risk. Not only has the EV industry failed to thrive, but the ripple effects have unsettled other sectors.

This isn’t an exaggeration.

French cognac producers are already on edge. Over these months, as a countermeasure to dumping, China planned to slap additional tariffs on European spirits. On September 17, French cognac makers took to the streets in protest, unwilling to let their industry pay the price for EU-China tensions over EVs. According to AFP, this was the first protest by French cognac producers since 1998, drawing around 800 people accompanied by 100 tractors in the southwestern French town of Cognac.

Cognac winegrowers hold up banners reading “the cognac sector sacrificed” during a demonstration in Cognac

Cognac winegrowers hold up banners reading “the cognac sector sacrificed” during a demonstration in Cognac

The French cognac industry fears it could “disappear from the Chinese market,” which accounts for a quarter of its exports. For some producers, China represents up to 60% of their sales. Any countermeasures by China could be devastating.

After China’s Ministry of Commerce announced on October 8 that it would impose temporary anti-dumping measures on EU brandy imports, shares of French spirits companies fell sharply, with Rémy Cointreau dropping 9.3% and Pernod Ricard down 4.6%.

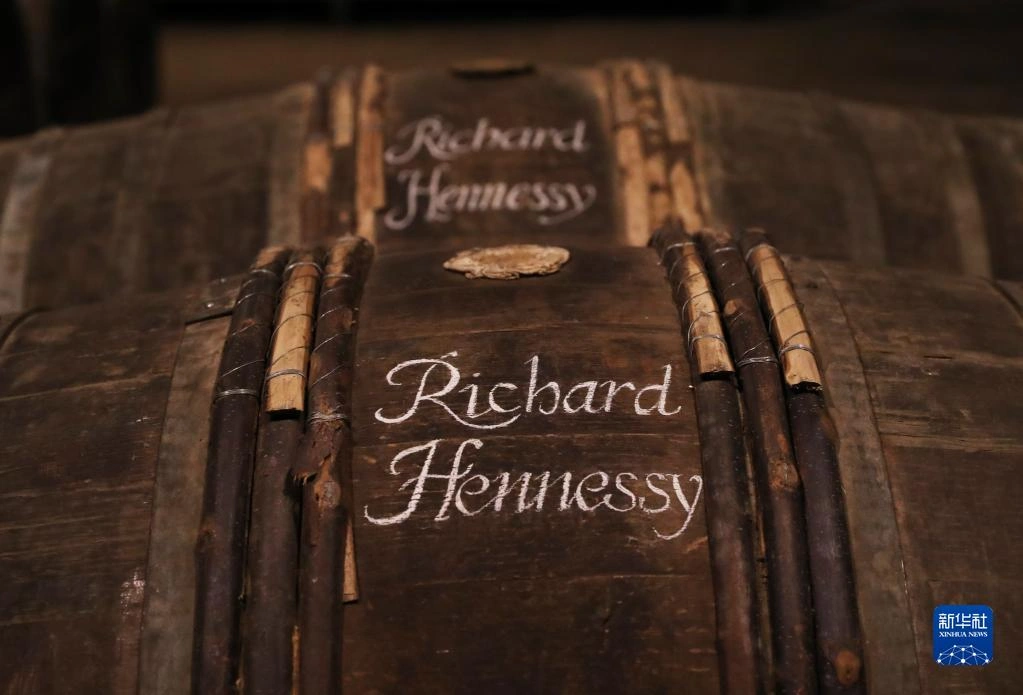

A cellar at the Hennessy cognac factory in France, storing aged spirits and samples.

A cellar at the Hennessy cognac factory in France, storing aged spirits and samples.

Noting the cognac industry’s growing concerns, the French government has promised support. Benjamin Haddad, Minister Delegate for European Affairs, recently stated that the EU and France will support cognac makers impacted by the China-EU trade tensions and may even consider providing financial aid.

Haddad’s assurances rely heavily on the EU’s Common Agricultural Policy, which offers various support mechanisms in exceptional cases, including a crisis reserve fund. But with European agriculture already hit by the Russia-Ukraine war—rising fuel costs and an influx of cheap Ukrainian products straining farmers—EU agricultural funds now require at least €450 million in allocations. This doesn’t even account for the emergency support the EU has provided to member states affected by frost damage this year. In recent years, Europe has seen an increase in natural disasters, raising doubts about how long this fund can hold out. There’s hardly any extra left to support France’s cognac industry—when people are struggling to put food on the table, who’s thinking about drinking brandy?

What worries the EU even more is that if it decides to support France’s cognac industry, it will also have to extend support to other sectors affected by China-EU trade tensions.

Take the European dairy and pork industries. Europe’s pig farming industry sees growing concerns over China-EU trade fractions. According to INAPORC (France’s pork industry federation), if China sets tariffs between 30% and 60%, the European pig farming sector could face losses of up to €7 billion, with France alone losing €500 million.

China is Europe’s largest pork export market. Higher tariffs could weaken this trade, flooding domestic markets in France, Spain, the Netherlands, and Denmark with surplus pork.

For France, China is particularly valuable as a market for pork offal, ears, and trotters. Anne Richard, Director of INAPORC, emphasized that only Chinese consumers buy these products in such quantities and at such prices. As Arnaud Rousseau, head of France’s FNSEA (the largest farmers’ union), put it, “We’re very concerned. Certain parts of the pig aren’t eaten here and need a market. China is crucial. If we can’t trade with certain countries, problems will arise quickly.”

The French dairy sector also anticipates trouble. In June, the Chinese dairy industry requested a subsidy investigation into EU imports. Such actions align with China’s laws to ensure fair competition and protect domestic industries. Applications that meet the filing requirements will proceed through the official investigation process and be publicly announced in accordance with the law.

China’s customs data reveals that the EU is China’s second-largest source of dairy imports, accounting for 36% of its total in 2023, following New Zealand. EU data indicates that in 2022, China imported €1.7 billion worth of European dairy products, including whey powder, butter, and fresh milk, with major exporters like the Netherlands, France, Germany, Ireland, and Denmark highly dependent on the Chinese market.

Recently, Les Echos reported on China’s dairy import trends, noting that as the world’s largest dairy importer, China imported €11.13 billion in dairy products last year, primarily including milk powder, infant formula, and whey powder. Although dairy consumption has steadily increased in Chinese diets in recent years, supported by government’s encouragement, per capita dairy consumption in China still falls below the global average. Over the past decade, French cheese exports to China have surged by 286%, reaching 6,306 tons in 2023, as a wide variety of French cheeses continue to attract growing interest and appreciation from Chinese consumers.

Chinese consumers shopping for dairy products in a supermarket.

Chinese consumers shopping for dairy products in a supermarket.

With such a promising market, no one wants to lose out, and China has plenty of options. In 2022, France ranked as China’s fourth-largest dairy supplier, while China became France’s largest non-EU export market for dairy products. President Macron invested significant effort to get French dairy companies onto the “farm-to-Chinese-table” fast track, but now he himself has derailed that train.

Some analysts suggest that France’s auto industry is weaker than Germany’s, particularly in the EV sector, making it more vulnerable to competition from Chinese electric vehicles. According to French customs data, imports of Chinese cars to France rose by 154% from 2021 to 2022, with the share of EVs increasing from 7% in 2021 to 26% in the first five months of 2023—a proportion that even surpasses Germany’s 20%.

While Chinese electric vehicles still represent a limited share of the overall French auto market, the French government has shown unwavering commitment to its green transition goals, emphasizing market protection and localized supply chains. This naturally led to its firm stance on imposing tariffs on Chinese EVs.

However, it seems President Macron underestimated China’s resolve to protect its interests. He believed that imposing tariffs would pressure China’s EV industry into compliance and encourage companies to set up factories in France, thus localizing the supply chain and allowing France to lead the global green transition—a symbolic move, given that the Paris Agreement was signed in France.

Back in June, Le Monde columnist Stéphane Lauer noted in his column that relying solely on EU tariffs against Chinese EVs wouldn’t be enough; Europe would need to close its industrial and technological gaps as well. Macron took this advice, hoping to leverage Chinese industry to accelerate France’s green ambitions, but his tariff strategy has clearly fallen short.

Now, France’s cognac, pork, and dairy industries are caught in what can only be described as a “collective panic,” realizing that Chinese countermeasures could spell disaster for these sectors.

Macron officially inaugurated the 90th edition of the Paris Motor Show

Macron officially inaugurated the 90th edition of the Paris Motor Show

Other French industries are feeling the strain too, uncertain about which sector might be targeted next. Will France’s luxury goods sector feel the impact? Could cooperation in high-tech pharmaceuticals, communications, or aerospace face cuts?

According to French media, Sophie Primas, Minister Delegate for Foreign Trade and Overseas French Nationals, is set to address China’s planned tariffs on brandy imports, along with new investigations into the dairy and pork sectors, during her visit to the China International Import Expo in Shanghai. This gesture signals a willingness for dialogue, but without genuine concessions, her visit may amount to little more than a symbolic move.

Although the EU has formally approved steep tariffs on Chinese EV imports, internal divisions are evident. And Europe’s troubles are far from over; EU nations are bracing for a potential return of Donald Trump. During Trump’s last term, some trade disputes between Brussels and Washington were left unresolved. Should Trump return, a renewed trade war between the U.S. and the EU seems almost inevitable.