Finally, An American Saw the Right Picture of China

Recently, a lengthy article titled “China is Winning, Now What?” published in American Affairs has garnered significant attention. The author, Nathan Simington, currently serves as the Chairman of the U.S. Federal Communications Commission (FCC), a position he has held since the Trump era.

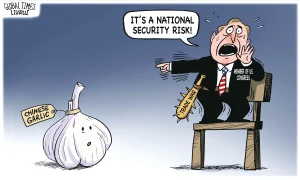

In the article, Simington does not attribute China’s rise to cheap labor or environmental disregard, nor does he believe that naive free trade policies from the U.S. and Europe “funded” China’s ascent. Instead, he argues that China’s rise is the result of a long-term, carefully planned industrial policy aimed at overturning the world order. In other words, he advocates for a China conspiracy theory and proposes a U.S. response.

However, Simington saw the right picture, but got the wrong point.

Screenshot of the web page of the article

Screenshot of the web page of the article

The rise of China is the most significant event of the 21st century and will undoubtedly shake Pax Americana. However, China’s rise is not a conspiracy but rather an overt strategy. Challenging Pax Americana is not the goal, but rather the inadvertent outcome.

Simington attributes China’s industrial success to a far-sighted industrial policy. He argues that China has built a comprehensive and mutually supportive industrial structure, overwhelming production capacity, complete supply chains, and outstanding power and transportation infrastructure, all aiming to overwhelm Pax Americana and seize global hegemony from the U.S. In his view, Chinese government documents that call for achieving global leadership in economic and technological fields serve as evidence of a Chinese conspiracy to seize power.

Only China Applies Industrial Policy?

Industrial policy primarily refers to government-led economic development plans and policies that support specific industries or technologies, particularly in high-tech sectors, defense, and regional pillar industries. The rise of Japan and South Korea can largely be attributed to such industrial policies.

The major consortiums in Japan and South Korea mainly developed and grew with the support of government industrial policies.

The major consortiums in Japan and South Korea mainly developed and grew with the support of government industrial policies.

On one hand, the West accuses China’s industrial policy of unfair competition. On the other hand, they implement certain industrial policies under various pretenses. For instance, NASA’s aerospace research has been transferred without charge, which is how companies like Boeing and SpaceX began. In Europe, fragmented and less competitive companies are merged into giants under government guidance, leading to the creation of Airbus. Therefore, the trade dispute between Boeing and Airbus essentially represents the competition between the U.S. and Europe in the aerospace manufacturing sector.

China’s Rise Aimed at Challlenging Pax Americana?

China’s rise has a long and painful prelude. In the agricultural era, China was once an advanced nation, but it was thoroughly defeated by the industrialized West, enduring a century of humiliation as a semi-colony. The desire for a developed industrial and technological base has been a shared aspiration among generations of Chinese people since the Self-Strengthening Movement in the 1860s. This goal was not something that suddenly emerged during the reforms and opening-up of the 1980s.

In the early years of Reform and Opening-up, China had a complete range of industrial and technological sectors, but their levels were relatively low, and there was a comprehensive gap compared to foreign technologies. The introduction of the Santana had a seismic impact on China’s automotive industry, while the LM2500 gas turbines used in two 051 destroyers were viewed as almost miraculous. On the level of everyday consumer goods, aerospace and military enterprises were heavily involved in assembling refrigerators and televisions. Domestic ballpoint pens even struggled with issues like ink leakage, while 555 cigarettes and Lux soap became symbols of status and luxury.

During this period, I personally participated in the development of the chemical automation sector in China. The control engineering curriculum, which integrated various specialties, focused on the analysis and comparison of different control solutions. The introduction of the Foxboro SPEC200 not only represented the highest level of unit instrumentation but also enabled integration with IBM’s ACS industrial control computers for SPC control. However, the domestic DDZ II type electric unit combination instrument still dominated university coursework and industrial applications. At this time, the first generation of Distributed Control Systems (DCS) had already been implemented in the U.S. and Europe.

Due to the inaccessibility of DCS technology, my team made significant efforts to stay abreast of advancements within a more achievable scope. We built a multi-loop digital PID controller based on the Z80 microprocessor. After much work, we finally got the assembly language system running on a breadboard, and we could have a metal enclosure made by the school’s factory. However, we struggled to find a solution for the front panel.

Using light-emitting diodes not only felt outdated but also took up too much space. The LCD on the new Casio calculator was very tempting, but when we contacted the automation instrument factory, they either didn’t have the time to respond to us or could not produce samples beyond their standard products, leaving us without even a complete rejection. Buying components from foreign vendors was out of the question due to budget constraints. In the end, we were forced to take our prototype to the industrial site for testing. Ultimately, with the team’s careful attention, the prototype completed its tasks during the trial period, but everyone knew it was still far from practical application.

In the 1980s, clothing and toys were the first wave of export leaders in China. Initially, fabrics and buttons had to be imported in large quantities from countries like South Korea and Japan, as domestic products often fell short in terms of style, color, and quality. This was also the era when the Pearl River Delta pioneered the trend of introducing technology. By purchasing a significant amount of second-hand equipment with Hong Kong investment, small-scale synthetic fiber production flourished under the guise of “imported technology.” The fabrics surpassed the mainstream state-owned enterprises in terms of style, color, and quality.

Chinese workers working in a state-owned fabric factory, 1980s

Chinese workers working in a state-owned fabric factory, 1980s

Meanwhile, the polyester spinning machine became a key project, initially aiming to replace the imported spinning machines used for small-scale synthetic fibers, with plans to gradually scale up production. The holes in the spinneret are extremely fine, requiring collaboration with the aerospace industry. The materials were gradually transitioned from imports to domestic alternatives. This represents the simplest form of import substitution, unrelated to competing with imported equipment.

To understand the technology of the spinning machine’s digital control system, my team spent a long time in Guangdong. I remember the workshop was deafeningly noisy; even shouting couldn’t make conversations audible, with sound levels likely exceeding 100 decibels. On the return journey, we took a boat from Guangzhou to Shantou and Xiamen for further research, specifically because these coastal special economic zones had been the first to introduce spinning machines. I vividly recall passing by the waters near Hong Kong and seeing a cluster of high-rise buildings springing up like bamboo shoots, which was quite striking. This was back in the era when the tall buildings in Shanghai could still be counted on one hand.

Aerial view of Shanghai and Hong Kong in the 1980s

Aerial view of Shanghai and Hong Kong in the 1980s

Looking back now, it’s clear how impoverished and struggling China was in those days. Yet, despite starting from such a humble and barren foundation, China developed into the world’s second-largest economic superpower within a generation. By purchasing power parity (PPP), China is already the world’s largest economy.

The Rise of China All Thanks to Industrial Policy?

Industrial policy certainly played a role, and various policy supports were definitely part of it, but the goal was simple: the Chinese people wanted to become prosperous. To achieve prosperity, industrialization was necessary, and to industrialize, China had to develop as many industries as possible. It wasn’t about monopolizing; it was about saving money and creating jobs. Gradually, the Chinese realized they could handle more and more industries, and in many fields, they grew to the largest, most efficient, and most advanced in the world.

The manufacturing-centered and technological localization nature of China’s economy is also an inevitable outcome of the times. Everyone knows that financial speculation is a quicker way to make money, but during the early stages of Reform and Opening-up, China had no money, so people had to earn it through hard work. Similarly, everyone understood that importing technology was simpler but the risk of being cut off from crucial technology must be taken into consideration. Only homegrown technology could be truly dependable.

In the early days of Reform and Opening-up, a saying often heard was: “If we don’t reform, we’ll be kicked out of the game.” Chinese people were deeply pained by their backwardness and eager for change. Two other commonly heard phrases were: “Development is the hard truth” and “Cross the river by feeling the stones.” This meant that any grand designs not only had to withstand the test of practice but also required continuous adjustment through experience, all aimed at eventual progress. Anything or anyone hindering development had to step aside because development was the key to survival.

In this way, through small but rapid steps and constant adjustments, China gradually built a vast, comprehensive, and advanced industrial system and supply chain, along with supportive power and transportation infrastructures.

The completeness and efficiency of China’s supply chain is one of the country’s strongest manufacturing advantages, which in turn accelerates rapid iteration and continuous innovation in Chinese manufacturing. If someone wants to make a robot, he could likely buy all the necessary hardware and software components in a single day at Huaqiangbei, Shenzhen. If anything is out of stock, it could be delivered the next day. German cars are highly competitive in the West, but even Volkswagen needs to increase cooperation with Chinese partners. In Germany, it takes 36 to 40 months to develop a new electric vehicle, whereas in China, it only takes 18 months.

The Chinese people have both vision and patience. Vision lies in their firm commitment to long-term goals, while patience is shown in their continuous trial and error, constantly correcting course. From the landlord class’s Self-Strengthening Movement to Sun Yat-sen’s bourgeois revolution to the socialist People’s Republic of China, the simple and earnest desire of the Chinese nation has always been to be treated as an equal by all nations. There is no conspiracy here, only the enduring aspiration of an ancient nation. Under the leadership of the Communist Party of China, this aspiration has been transformed into an achievable goal, and it is being realized step by step.

However, industrial policy has never been the primary tool for realizing the aspiration of national rejuvenation.

The core of industrial policy lies in government will, with infrastructure such as railways and highways being the best embodiment of that will. Many high-speed rail lines in China have operated for years without turning a profit, but the economic benefits they generate for the whole country are immeasurable. The same goes for the construction of highways, urban infrastructure, fiber optics, and mobile base stations. China’s nominal GDP grew from less than $400 billion in 1990 to just under $18 trillion in 2023, and the extent to which this growth can be “attributed” to the proactive development of infrastructure is an interesting topic for discussion.

The Chinese government possesses strong will and robust execution capability, but this does not mean that all developmental achievements are solely due to successful industrial policies, nor does it imply that industrial policies will automatically lead to success. Additionally, industrial policies are not static; they must evolve to meet changing circumstances and challenges.

The significant development of Chinese refrigerators, televisions, cars, and steel is less a result of industrial policy and more a consequence of enterprises across the country recognizing development opportunities and competing freely. In intense competition, survival of the fittest is the hard truth. During this process, China has experienced overcapacity in many sectors. On one hand, idle capacity leads to waste and cutthroat competition; on the other hand, the extreme drive to cut costs and enhance efficiency compels industries to advance to higher levels, with technological progress and product differentiation creating opportunities to utilize idle capacity, leading to a virtuous cycle. Moreover, overcapacity essentially reflects an excess of capital and human resources, allowing for rapid investment whenever development opportunities arise, while the labor force can also be mobilized accordingly. This was particularly evident in the explosive growth of the electric vehicle sector.

Since the Reform and Opening-up, the automotive industry has been a key focus of development in China. However, for a long time, there has been excess capacity but a lack of advanced technology. Imported foreign vehicles dominated the market, largely due to China’s internal combustion engine and transmission technologies lagging behind global standards. However, electric vehicles represent a completely different field, leveling the starting point. The surplus investments and human resources suddenly found their destination, leading to the subsequent explosive growth in the sector.

The factory of BYD, China’s leading manufacturer of EV

The factory of BYD, China’s leading manufacturer of EV

In this regard, industrial policy has a significant element of “accidental success.” China’s strong push for electric vehicles was primarily driven by concerns over energy security and environmental protection. Oil has been a clear shortcoming for China, and for both sustainable development and national security reasons, it is essential to reduce reliance on imported oil. As the largest carbon emitter in the world, China faces the undeniable reality that it also needs clean air.

The electrification of vehicles is an obvious choice, as it bypasses the bottlenecks in China’s internal combustion engine and transmission technologies. Once electric vehicle technologies were introduced, they experienced explosive growth—unexpected but logical. The vast lithium resources abroad resemble the age of geographical discoveries; in a time when few were paying attention, those who planted their flags first reaped the rewards. This situation doesn’t lend itself to notions of conspiracy or grand strategy.

In its development, China has also been mindful of reducing bubbles in the economy. The real estate sector represents the largest bubble, while the internet industry has also faced risks of disorderly growth and potential bubbles as well. Despite Western skepticism, China has willingly accepted a temporary slowdown in economic growth to actively deflate these bubbles, aiming for healthier development in the future. This approach exemplifies the highest form of industrial policy at the national level.

China also emphasizes orderly development through pilot programs before broader implementation, which aligns with the principle of “crossing the river by feeling the stones.” China has never hesitated to share its experiences, particularly in its interactions with countries in Asia, Africa, and Latin America. If the U.S. and Europe are interested, China is open to sharing as well. However, when they arrogantly interpret and replicate the “Chinese experience,” attempting to revitalize their manufacturing sectors through industrial policy, they should not blame China for any failures they encounter.

For industrial policy to succeed, a key factor is the establishment of a withdraw mechanism. The role of policy guidance and support is undoubtedly important, but development results from the synergy of policy promotion and demand-pull; government investment acts more as leverage, while commercial investment is the muscle. Only in this way can the government ultimately withdraw, allowing the industry to develop autonomously through commercial operations.

If support needs to be perpetual, it ceases to be industrial policy and becomes a different form of protectionism, merely substituting subsidies for tariffs. For the U.S. to revitalize its manufacturing sector, the focus should not be on government will and industrial policy but rather on recognizing the essence of the economy.

The essence of the economy is simply money and real assets. For Chinese people, real assets are valued more than money, and money serves to acquire these assets. When Chinese people have money, they tend to buy houses, even if they already have enough living space. For young people, having a home is a necessity when getting married, and long-term renting is unacceptable, as they feel that renting for a lifetime means never owning a property. At the same time, they believe money is what “you can’t take with you when you die.”

Driven by this fundamental mindset, developing the real economy is essential. During the early stages of the reform and opening up, there was discussion about financial speculation, but before any steps could be taken, the 2008 financial crisis in the United States scared people off. The larger reason, however, is that there wasn’t enough money to play the games that only the wealthy could afford; thus, people had to work diligently, relying on their skills to earn a living.

The US is On the Wrong Path to Understand China

In the American mindset, money outweighs material possessions; anything can be bought with money. Young Americans aren’t in a rush to buy houses; instead, they prioritize investing early. While young people in China stretch their finances to buy a house, even when they can’t afford it, American youth, lacking funds, are more inclined to invest in stocks and mutual funds. Marriage is often seen as optional, and the concept of a “wedding house” is almost unheard of. Renting while investing in the stock market sounds appealing to them. For them, a house is just a thing that one doesn’t take with them when they die.

This mindset applies in business too. Driven by this fundamental thinking, light asset operations become essential. Manufacturing involves complexities like labor relations, government interactions, and environmental protection, making it cumbersome to pivot when market trends shift. In contrast, light asset operations offer much more flexibility, as issues related to labor, government, and the environment become “other people’s” problems. Market shifts present perfect opportunities for short-selling, as there was never a plan to hang everything on a single tree.

Wall Street, the heart of the American economy

Wall Street, the heart of the American economy

Even when investing in manufacturing, Americans tend to prefer sectors like software, the internet, and e-commerce—what could be termed “soft manufacturing.” Currently, the hot trend is certainly AI. The U.S. investment community is never deterred by large investment amounts but fears long payback periods. Economic cycles require that investments be recouped quickly, as survival through the next economic downturn is uncertain otherwise. Hard manufacturing investments typically have long payback periods, and infrastructure projects demand sustained long-term commitment, which many seek to avoid. While American companies remain among the world’s leaders and U.S. technology remains advanced, they have shifted to retaining design and marketing while outsourcing production and specific research and development, aligning perfectly with the principles of light asset operations.

The rise of the United States undoubtedly began with manufacturing. However, that was still in the early stages of globalization, where domestic production remained the backbone of national economies. The U.S. was somewhat isolated from Europe, operating as a manufacturing island. With advanced transportation systems, its comparative economic advantages reached out globally, while the strength of the dollar and its status as the “world’s currency” allowed the U.S. to become a major beneficiary of globalization.

After the United States made its first fortune, the game of making money from money took off, leading to a financial-centric national identity. Political figures like Marco Rubio have even pushed for legislation that imposes sanctions on countries, institutions, and individuals that promote de-dollarization. The reason is simple: the U.S. is left with little but its dollar. If the dollar loses its value, America will lose its hegemony, so it’s imperative to prevent that from happening.

In this regard, Simington is somewhat more astute than Rubio, as he argues that the U.S. needs not only industrial policy but also reforms in taxation, accounting, and financial regulations to achieve reindustrialization. However, the challenge of reindustrialization in the U.S. inevitably revolves around costs. Labor costs, regulatory costs, and environmental costs make American manufacturing too expensive. Even if industrial policy manages to support a few advanced technology companies, the reluctance of the business community to invest means that the government struggles to withdraw support, leading to permanent subsidies that lack competitiveness and become a heavy burden on taxpayers.

Simington believes that China has won and inadvertently contributed to America’s decline. He argues that for the U.S. to reclaim its status, it needs to learn from China. However, China’s development is not about winning; it’s about improving upon its past. China has no intention of causing America’s decline; its growth is driven by its own efforts. If America is experiencing decline, it can only be due to its own actions.

If the U.S. truly wants to learn from China, it will need to embrace a real assets-based economic mindset rather than a money-driven one. But the question remains: Can America make it?