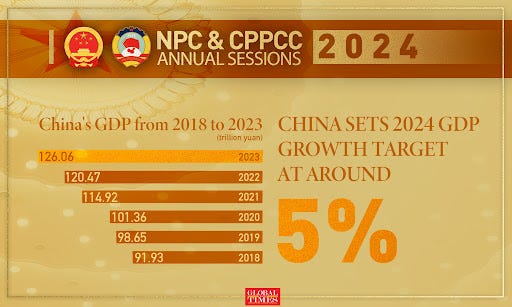

China Sets GDP Growth Target at Around 5% for 2024

China Sets GDP Growth Target at Around 5% for 2024

China’s State Council held a press briefing on March 5th, during which the head of the drafting team for the Government Work Report, Huang Shouhong, provided an interpretation of the report and answered questions from journalists. One of the key topics discussed was the GDP growth target set for 2024, which aims to achieve a growth rate of around 5%.

When asked about the rationale behind setting the target at this level and the measures that will be taken to ensure its attainment, Huang Shouhong explained that the target was determined based on comprehensive considerations of various factors, including both domestic and international situations, as well as current needs and long-term objectives. He emphasized that the target is aimed at addressing the pressing issues of expanding employment, increasing household income, and mitigating risks, all of which require a certain level of economic growth.

Huang also noted that the effects of major policy measures implemented in the second half of the previous year are expected to continue to manifest in 2024. Beijing remains optimistic about achieving the target and is committed to implementing necessary measures to sustain economic growth and ensure social development.

China Seaside Property Prices Plummet

In recent days, a property transaction went viral on Chinese social media, with hastags “seaside property,” “near Shenzhen,” and “ultra-low price” trending together on Weibo. A unit of a semi-detached house of about 154.11 sqm was sold for a mere 250,000 RMB.

Since the concept of commercial housing matured in China, the craze for seaside properties spread from Hainan and continued northward. However, in recent years, the once-soaring prices of seaside properties have been on a downward spiral in several cities, including Huizhou and Weihai.

The decline in seaside property prices can be attributed to various factors. Firstly, the oversupply of properties has led to intense competition among sellers, forcing them to lower prices to attract buyers. Additionally, changes in government regulations and policies have impacted the real estate market, leading to a slowdown in demand. Furthermore, the evolving preferences of buyers have shifted towards other investment options or different locations, reducing the demand for seaside properties. As a result of these factors, there is now an abundance of low-priced second-hand seaside properties flooding the market, which has diminished their previous appeal.

Gold Hits Record High on March 5, Surging Over 1% to $2141 per Ounce

On March 5, the price of spot gold soared to a historic high, now trading over 1% higher at $2141 per ounce. This surge has broken the previous record set on December 4 of last year, at $2135.39 per ounce, with gold prices climbing over $100 in the past five trading days. In conjunction with this milestone, the Shanghai Gold Exchange (SGE) announced adjustments to transaction fees for certain contracts.

Effective from March 5, 2024, to December 31, 2024, the transaction fee rate for intraday short positions on Ag(T+D) contracts will be 0.0075%.

During the same period, the fee rate for gold price inquiry swaps on the main board inquiry transaction platform and the inter-bank market, for the far end of the term range from TOM (inclusive) to SPOT (inclusive), will be set at one in a million.

Also, from March 5, 2024, to December 31, 2024, the transaction fee rate for main board members and international members participating in iPAu99.99 contract swaps for the far end of the term range from TOM (inclusive) to SPOT (inclusive) will be one in a million.